By Jan Schalkwijk

South Africa is an attractive market for investors who wish to gain exposure to African growth but wish to avoid the pitfalls of less mature markets in terms of liquidity, trading costs, limited data, and transparency. African GDP is forecasted to reach $2.6 trillion by 2020, up from roughly $1.6 trillion today. South Africa is well positioned to play an integral part in this growth, with its mature and competitive industries and proximity to African markets. Additionally, South Africa will benefit from the growth of its biggest export market: China. As such South Africa ? uniquely positioned at the confluence of the ?Africa? and ?BRICS? themes (BRIC countries + South Africa) ? offers a compelling case for investors with a long-term horizon and the patience to see these opportunities materialize.

In the 10 year period through 2011 Sub-Saharan Africa real GDP grew by 5.76% per year, compared to 1.64% for the United States over that same period. This trend is expected to continue as Africa is forecasted to nearly double its GDP over the next 10 years.

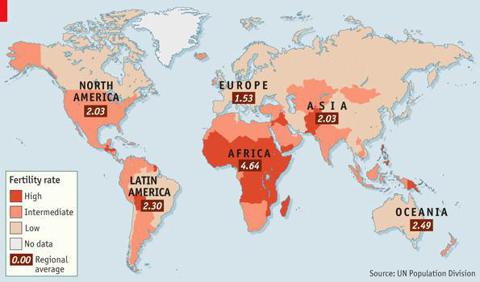

On October 31st of 2011, the United Nations marked the birth of the world?s 7 billionth living person. Though it only took 12 years to go from 6 billion to 7 billion, world fertility rates have been steadily declining, and demographers widely expect global population to level out by 2050 in the 9 to 9.5 billion range. It is the slowdown in fertility rates that creates what is called the ?demographic dividend.? When the number of children a woman is expected to bear falls from a high rate to a lower rate, an outsized generation (or two) comes of age, followed and preceded by relatively smaller generations. When this ?bulge? group reaches adulthood, the demographic dividend kicks in, resulting in a large (productive) working population with few dependents. Africa, more than any other continent, is in a sweet spot to reap the next demographic dividend, as can be seen in the below graph (The Economist, October 2011).

(click to enlarge)

None of the BRICs can match it: Brazil and Russia have a fertility rate below the replacement rate, China will be greyer than the U.S. by 2020 and than Europe by 2030, and even India is declining to replacement rate fertility. Furthermore, China may actually have fewer productive workers in 2050 than it does today. In fact, Africa will account for both the highest drop in dependency ratio (number of dependents per working-age adult) as well as 40% of the additional 2.3 billion increase in the global population between now and 2050. Additionally, unlike China, Africa has not committed rampant sex-selective abortions, which could create major social unrest and thus economic upheaval in China by the 2020s, just as Africa will be coming of age.

In the meantime, however, China propels global economic growth, and Africa is no exception. China is Africa?s largest trading partner, accounting for 12% of African exports (?African Acceleration?, Societe Generale, Cross Asset Research, October 2010). China?s importance to African trade cannot be overstated. Through the first three quarters of 2011, trade between China and Africa reached $126.9 billion, according to the China Ministry of Commerce. This represents a 30% change compared to the same period one year ago and is in line with the break-neck pace of growth of 28% per year over the?last 10 years. Though Africa needs China?s help in developing its infrastructure, the relationship is clearly important to China as well. China?s Outward Direct Investment (ODI) in Africa increased from 2.6% of its total ODI in 2003 to 9.8% in 2008 (2009 China Commerce Yearbook). By 2010, China had established diplomatic relationships with 49 of the 54 countries on the African continent and had direct investments in?48 countries.

China?s motives are unambiguous: to feed its insatiable demand for energy and natural resources. In fact, China?s strategy is not all that different from how Western countries have traditionally approached Africa, with the notable exception of China?s lack of involvement in Africa?s domestic politics. Although the relationship is not without friction, the net benefits of China?s involvement in Africa are widely viewed as positive.

So how can US investors take part in the African growth story? Consider investing in ETFs like Market Vectors Africa (AFK), or iShares MSCI South Africa Index (EZA). The former has broad pan-Africa exposure, while the latter ? as the name suggests ? is more focused on South Africa. Though EZA is a South Africa fund, it is important to note that South African companies, often formidable global competitors, stand to benefit from the broader Africa story, as many have set their sights on sub-Saharan Africa for future revenue expansion. In essence an investor in South Africa captures the best of both worlds: companies with the sophistication of those domiciled in mature economies but with the growth potential of those in emerging and frontier markets.

Editor?s note: Jan Schalkwijk originally wrote this piece for U.S. investors on Seeking Alpha

About CP-Africa.com

Subscribe to get insights on business, technology and culture in Africa

Subscribe

Source: http://www.cp-africa.com/2012/09/21/the-case-for-investing-in-south-africa/

Talk Like a Pirate Day Chase.com Lady Gaga Shakira iOS 6 Features

No comments:

Post a Comment